Don’t miss the end of today’s post; PFE has been showing some bullish momentum lately that has the stock near the $55 price I was assigned shares of the stock at nearly a year ago. That’s setting up a nice opportunity to generate some additional income against the position with a covered call trade. If you’re holding shares in this stock as I am, you’ll want to take note of that set up.

PFE is also a stock that I’d like to use as a case study for one of the reasons that I think my approach to put selling makes sense, even in uncertain market conditions like we’re dealing with right now. The Fed just raised interest rates (again), and signaled that their target interest rate is still .75% – 1% above the level they just raised to. Even if, as some hope, the pace and size of future increases begins to moderate, that means that rising costs from higher interest rates are going to continue to be an issue that everybody, corporations and consumers alike, are going to be contending with the year ahead. It also seems to have an increasing number of investors betting that the proverbial “soft landing” everybody is hoping for isn’t going to happen, and instead we’ll be dealing with straight recessionary conditions next year.

That’s a scary story that makes it tempting to draw in as much cash as possible, sit on the sidelines and wait to ride out the storm. I think that’s a reactionary mindset that dismisses, if not outright ignores the reality that opportunity is still there for those who are willing to take a deliberate, conservative, and long-term view of the stocks they’re following.

If you’ve attended my webinar, or read these posts for any kind of extended time, you know that I look at my put selling trades as opportunities to own stocks I like at price that I believe represent good values. That often means buying stocks that are already at the low end of their historical price ranges, which is something that I think takes some of the edge off of the risk of investing in that stock when broader market conditions are uncertain. It certainly doesn’t mean the stock won’t go lower – you can look at any of the stocks I’ve held over the past three years or so to see that, in many cases I’m still looking at drawdowns of 30%, 40%, or more from the prices I was assigned my shares at. It does mean, however, that looking at the company through the lens of fundamental strength and value lets me paint a different picture than most investors think about.

PFE is a great example of what I mean. After being assigned shares of this stock at the end of January of this year at $55, I watched the stock bounce between about $47.50 and $54 for most of the first half of the year. The stock broke below that $47.50 floor (or support level) in August and didn’t find a new bottom until mid-October at around $41.50. That’s a -24.5% drop from my purchase price in that time, and no matter whether you think about that in terms of unrealized or realized loss, that’s a significant amount. For most investors, seeing that kind of drop is like taking a punch to the gut – it makes you feel a little sick to the stomach.

Instead of acting on that first, panicked impulse, I’ve held the course and kept track of PFE’s quarterly reports. Their fundamental profile remains solid, and while the value proposition is admittedly lower than it was when I was assigned my shares a year ago, it’s still above my purchase price. That information, along with my requirement to work only with dividend-paying stocks has helped me stay more objective. The stock’s early price activity this year around my purchase price also allowed me to set up a couple of covered call trades that expired worthless, leaving me with my shares in each case, but with practical income from the covered call premiums that supplemented the passive income from my dividends. I can also count the premiums from all income-generating trades – my initial put sale as well as my covered calls – along with dividend distributions received while I’ve held my share against my initial cost. Here’s what that looks like right now:

PFE Cost basis (as of 12/15/2022)

- Initial assignment, 1/28/2022: $55 x 100 shares

- 1/2022 put sale: $.95

- 4/2022 covered call (expired): $1.10

- 6/2022 covered call (expired): $.87

- Net Premiums: $2.92

- Dividends: $.40 x 3 = $1.20

- Net cost basis: $55 – $2.92 – $1.20 = $50.88

While the stock remains a little below my $55 assignment price as of this writing, the fact that my net cost in the stock is a little less than $51 means not only that I’m in a net positive real position (about 5% for the year based on the stock’s most recent price as of this writing), it also helps put new trades and price action in perspective. For example, while I typically like to write covered call trades above the price I was assigned at, in many cases I’ll use strike prices that match my original assignment price. That’s because, under current market conditions, the ability to retain financial flexibility is, quite frankly, at a premium right now, and freeing up capital to keep my powder dry is a good thing. And while 5% return for a year might not sound great, it sounds a lot better than looking at a stock I bought at $55, and is running below that price to think I’m just looking at another loser.

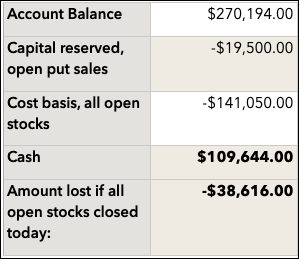

I think it’s also worth taking a minute to beat my position sizing drum, yet again. I only sold one contract for this position, meaning that I only hold 100 shares in PFE. That was a conservative position size of a little more than 2% of my total account when I placed the trade. The reality of the kind of market we’ve been dealing with for the past couple of years is that put selling, even with a value-centered focus like mine, is likely to take on more assignments, and hold stocks for longer periods of time than when the market is clearly, categorically bullish. I recently ran through all of the currently open positions I hold to evaluate just how exposed to more market risk I am. While I am holding about 20 stocks at present, with some positions having been held for three years or more, no one position was more than about 5% of my total account when I placed the trade. over the past year or so, those size have become even more conservative as I’ve purposely pared back the number of contracts sold to limit my assignment risk even more. And while there is continued risk in those positions, my financial flexibility is still healthy. Here’s a summary of my portfolio based on my analysis about a week ago to illustrate:

This doesn’t mean that I’m out of the woods, or that I can stop being cautious and conservative – the size of the unrealized loss shown in the final row is a clear sign that continued vigilance is needed. The fact that I still have about 40% of the account available in cash reserves, however, does mean that I can continue to look for good trades. I don’t turn a blind eye to additional risks in the open stocks I hold, but this understanding also makes it easier to treat each position on a case-by-case basis and consider them each on their own merits. That improves my decision-making process dramatically, since I don’t have to worry about the entire portfolio all at once.

Covered Call: PFE

If you don’t already own shares in PFE as I do, you may use the trade outlined below to initiate a new position; however, before you do, make sure to run through your own analysis of the stock’s fundamental strength, value proposition, and income opportunity. Make sure the trade meets your investing objectives, style and preferences, and needs before you place a trade. Also, keep in mind that all return numbers listed here are based on my own assignment prices; you should expect to see different return numbers depending on the price you pay for these stocks. Also, remember that all pricing information shown here is current only as of this writing; you should expect to see different pricing from your broker.

- PFE Current Price: $53.47

- Covered Call: sell the January Week 2 (expires 1/13/2023) 55 Call

- Current Bid: $.90

- Return, not called out: 1.63% (based on my $55 assignment price)

- Called out return: 1.63% (based on my $55 assignment price)

- This trade expires in 29 days.

If you are a new subscriber, please take some time to review the videos in the Getting Started area of the website. These will give you a pretty comprehensive view of the value-oriented approach I use to generate income with put selling and covered calls. You will also find it useful to read my Frequently Asked Questions article. Also feel free to review my previous posts as you’ll find additional answers to many of the questions you may have.

Rebel Income Portfolio : https://www.investivtg.com/rebel-income/

Rebel Income Put Sale Process Watch This Video Below

Rebel Income Portfolio is managed by Thomas Moore. You can access his recent content here and register for upcoming webinars here.