READY TO IMPROVE YOUR INVESTING RESULTS?

Whether you’re an experienced investor who wants fresh insights on the market, or a beginner who wants to learn the ropes, we’ve developed tools to help you accomplish your goals

Whether you’re an experienced investor who wants fresh insights on the market, or a beginner who wants to learn the ropes, we’ve developed tools to help you accomplish your goals

Whether you prefer to buy low and sell high, or trend trade the momentum, the most important and overlooked key to successful trading is proper risk management. Too many traders focus exclusively on the “system” or methodology.

While this is important—if your position sizing is always appropriate—you are less likely to succumb to your emotions and “panic” when a position moves against you, causing you to “sell out” before you capture the intended gain.

Volatility and risk are NOT synonymous. Risk is always the permanent loss of capital, while volatility is simply part of price discovery.

This is not to say you shouldn’t also have a stop in place to protect capital, but with proper position sizing you can allow the stock or underlying security a bit more “wiggle” room between your entry and your stop price, allowing the market the necessary “volatility” to discover the securities true underlying value.

As the trade begins to work in your favor, you can adjust and tighten your stop a bit more, should you choose to do so.

When it comes to trading and investing, there are myriad ways to “skin the cat.” To say one method is superior to another is laughable.

Anyone who has traded long enough, realizes there are certain market conditions where a given system will thrive, and others where its performance may suffer.

Your system/approach should match your personality and natural market inclination (value/momentum – longer term/shorter term).

The combined market experience of the Investiv Trading Group traders is 65+ years. And while we each approach trading and investing from a different perspective, both technically and fundamentally, we believe we have uncovered the “natural rhythm” of the markets which can be applied to both trend following momentum/growth) and trend reversal systems (value), as well as short term trading and long term investing.

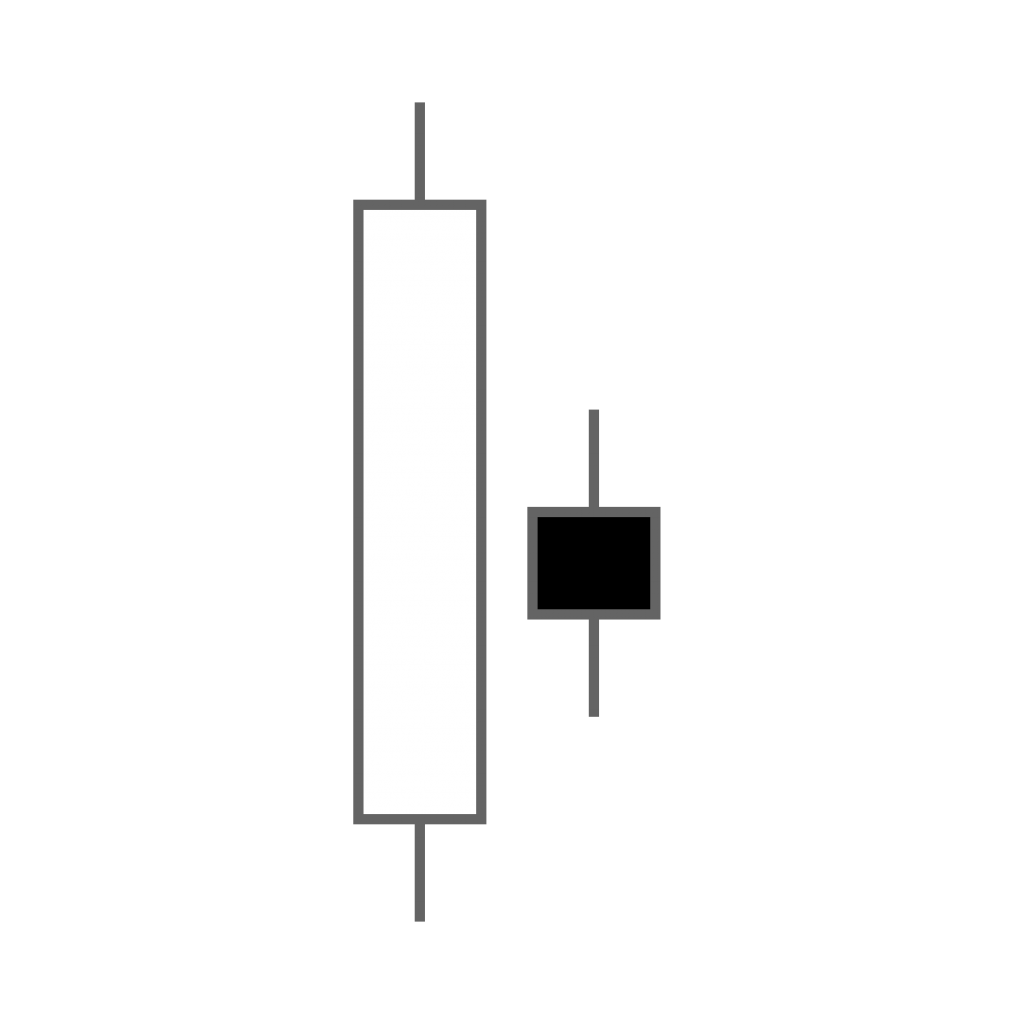

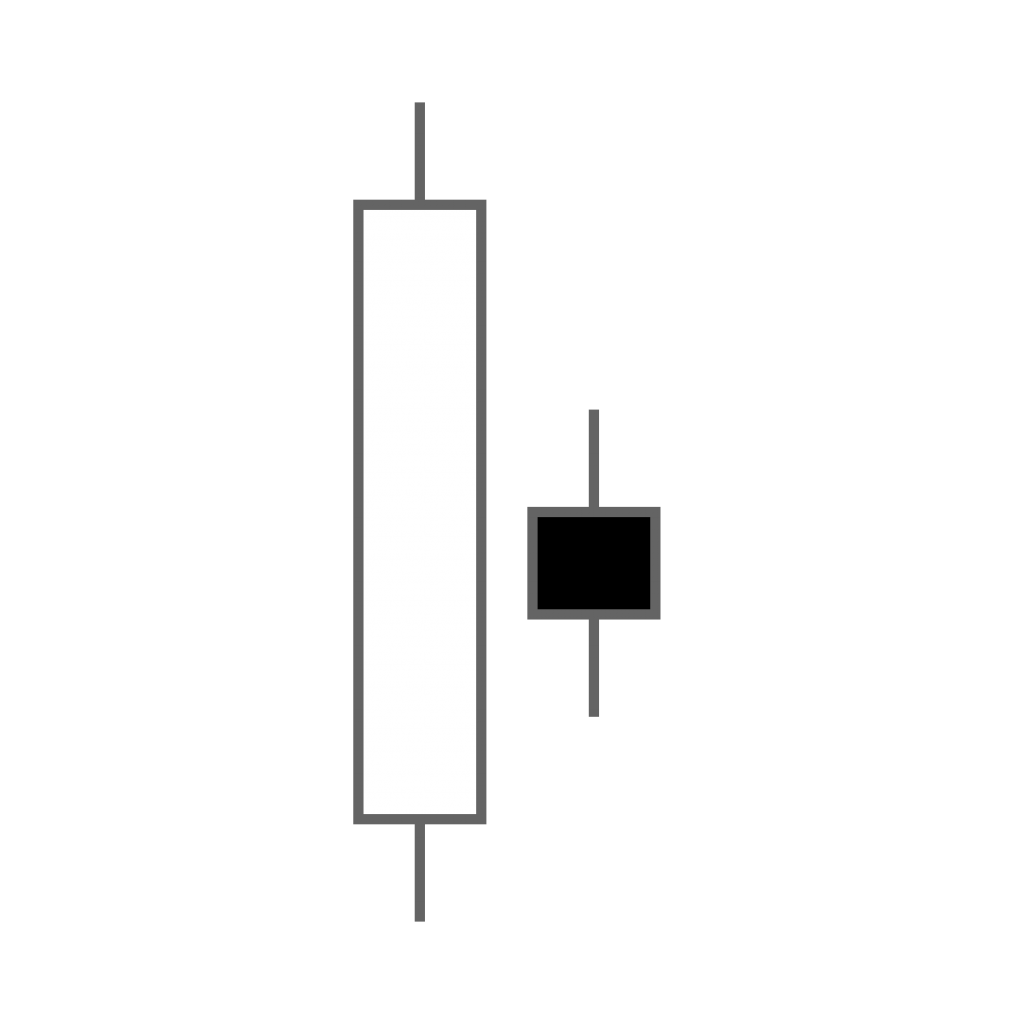

We believe understanding this “natural rhythm” gives any trader an edge, regardless of their trading style or system. The focus of the Investiv Trading Group is to teach traders this “natural rhythm” which manifests as repetitive chart patterns that work time and time again.

Choosing a strategy includes deciding whether to approach the market from a trend following (momentum) or trend reversal (value) perspective. It also includes choosing your optimal time frame.

Some people prefer a longer term buy and hold approach, while others prefer shorter term swing trading. Some choose to do both. Finally, once a high probability trade set-up has been identified, one has to decide the best way to manifest that bullish, bearish, or neutral opinion. Do you buy an individual stock? Do you buy an ETF? Do you incorporate options for leverage and or risk management (hedging)?

As part of the Investiv Trading Group, you will learn how to identify long term value-oriented investing opportunities, contrarian position trading opportunities (60 days to 6 months), momentum-based swing trading opportunities (3 days to 3 weeks), as well as short term option trading and option income generating strategies.

In addition, you will also be provided, via email/text, specific trading “alerts” based on each of the above mentioned methodologies. Over time, you will develop an individual and specific approach to trading and investing that works best for you.

One good trade can pay your lifetime membership !